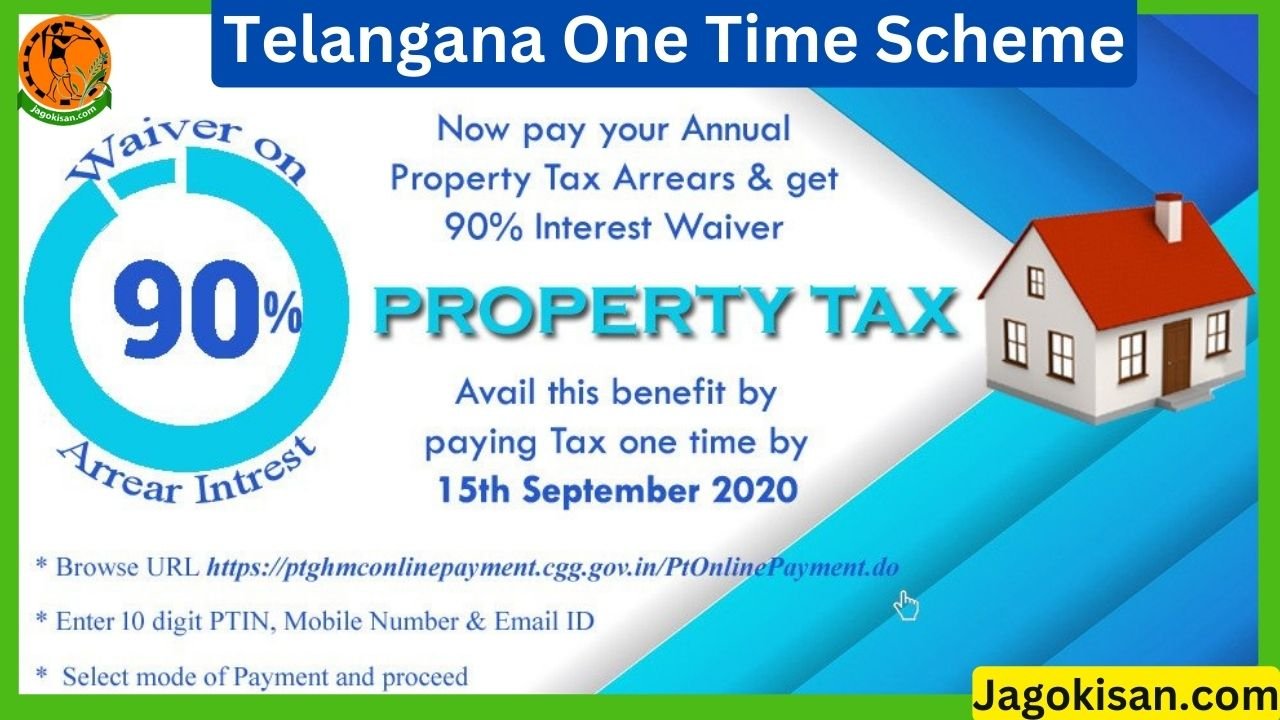

Telangana One Time Scheme Benefits :-GO Rt No Municipal Administration Published by the Department of Municipal Administration and Urban Development.

However, taxpayers will have to pay the entire tax bill—basically plus 10% accrued interest—in one lump sum from 2021–2022

The one time scheme will be implemented on a campaign basis with the scheme scheduled to end on October 31.

It covers cities and local bodies across the country including GHMC. 90% of all such interest/penalties shall be deducted from future payments for persons who have paid all of their property tax bills—including interest and penalties—by March 2022 of the current fiscal year.

All ULBs, including GHMC, have property tax arrears of Rs 1,999.24 crore, the GHMC commissioner and director of municipal administration said. Its outstanding interest is Rs. 1,626.83 million.

The order also directed officials to establish a system for day-to-day monitoring and transparent implementation of the program.

Telangana One Time Scheme Benefits

The GHMC Commissioner and Director of Municipal Administration have been directed by the Department of MA & UD to promote the scheme and ensure mass participation.

They are required to talk to property owners with outstanding balances, text message, call and promote the program in print and electronic media.

The OTS program is proposed to benefit taxpayers. By October 31, 2022, the system must be missionally deployed and properly distributed. The secretary requested that the concerned municipal authorities put in place a system of daily monitoring and ensure transparency of the one-off policy.

Arrears in Telangana’s Urban local bodies now Reach 1,999.24 Crore

The GHMC commissioner and director of municipal administration are said to be concerned about arrears of Rs 1,994.24 crore in unpaid property taxes attached to all municipal and local bodies including GHMC.

The state government has created a Time Schedule (OTS) to repay the debt and cancel 90% of the interest, helping people dealing with property tax arrears. Waiver available through FY2021–2022.

Telangana One Time Scheme Benefits FaQs?

What is the one time settlement scheme in Telangana?

one time scheme is extended to Luxury tax, Entertainment tax, RD Cess Act, Profession tax Act, Entry of Motor vehicles into Local areas tax Act

What is the discount on property tax in Telangana?

The Greater Hyderabad Municipal Corporation (GHMC) has rolled out the Early Bird Scheme for the financial year 2023-24 offering a 5 per cent rebate on property tax

What is the GHMC tax scheme?

The Greater Hyderabad Municipal Corporation (GHMC) has recently launched the Early Bird Scheme for the financial year 2023-24, which offers a 5% rebate on property tax. The scheme will end on April 30, and the rebate will only apply to the current year’s tax and not on arrears

What is the early bird scheme of GHMC property tax?

offers a 5% rebate on property tax to building owners, but only on the current year’s tax and not on the arrears

How can I reduce tax on my property sale?

reinvesting all the proceeds availed from the sale in another property within a certain time frame

How many times property tax is paid in a year in Telangana?

the State government’s revenue by paying property tax to the Greater Hyderabad Municipal Corporation (GHMC), which is levied on a bi-annual basis or twice a year. The last dates to submit the property tax in Hyderabad are July 31 and October 15 each year.

Farmer brothers, if Jagokisan.com, are given Telangana One Time Scheme Launched, Waives 90% Interest on Property Tax with the information then plz like and share so that other farmer brothers can also be helped.