ESIC Online Payments:- ESI Scheme’s information service portals are designed to facilitate hassle-free transactions for both employers and employees. This process includes online payment processing and compliance for all parties.

Employers can make monthly donations through the platform. SBI account holders with net banking access can now make online payments. Read below for detailed information about ESIC Online Payment.

ESIC Online Payment Details in Highlights

| Scheme Name | ESIC Online Payment |

| Initiated By | Government of India |

| Beneficiary | Indian Citizens |

| Objective | To offer an online challan payment option |

| Payment Mode | Online |

| Official Website | https://www.esic.gov.in/ |

Features & Benefits

- Employees National Insurance Corporation members can now pay their premiums online.

- Health Insurance Social Security Program for India Employees Employees National Insurance is provided by National Insurance Corporation.

- Of the amount owed to employees, employers contribute 4.75%, while employees contribute 1.75%.

- If the employee’s daily wage is less than ₹ 137, he/she should not contribute to ESIC.

- SBI account holders who have access to net banking services can pay their ESIC bills online.

- Citizens need to go to government offices to pay their bills

- Online billing simplifies the process, saves time and effort, and improves process transparency.

- Companies and employees can pay for ESIC online.

ESIC Online Payment Objective

The main objective of ESIC’s online payment system is to enable customers to pay their premiums without visiting a government office. This project makes the system more open while saving time and effort.

Citizens must have access to pure banking services to enable online payments. Employees National Insurance Company contributions are compulsory for both employers and employees, and can now be paid from home conveniently.

Steps to Register on ESIC Portal

To register on ESIC Portal, the user needs to follow the below given steps:

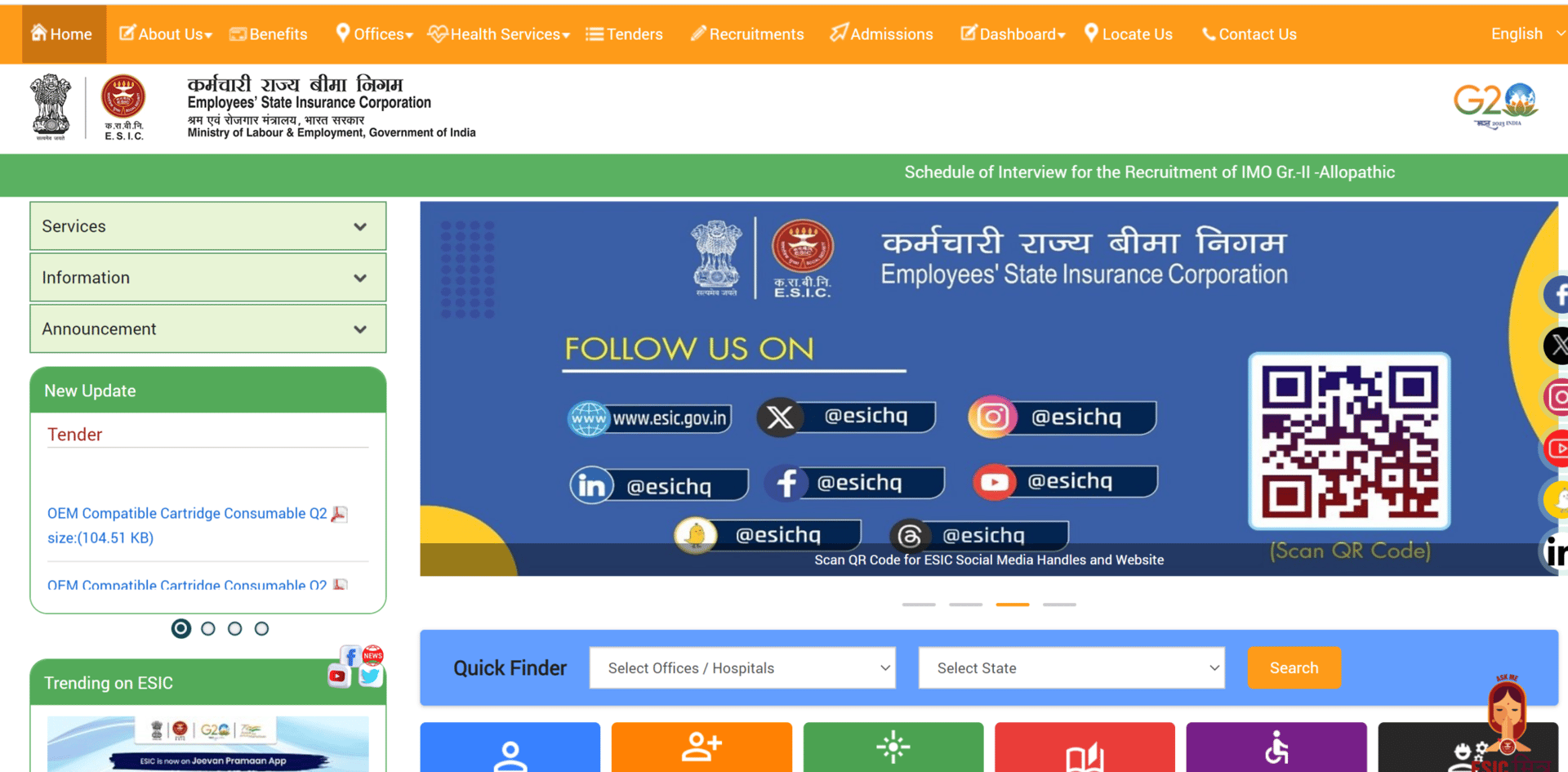

- First of all, go to the official website of ESIC i.e., https://www.esic.gov.in/

- The homepage of the website will open on the screen

- Click on the Employer Login option

- The login page will open on the screen

- Click on the Sign-up option

- The registration form will open on the screen

- Now, enter all the required details

- After that, click on the submit button to complete the registration process

Steps for Making ESIC Online Payment 2024 – Complete Guide

- First of all, go to the official website of ESIC i.e., https://www.esic.gov.in/

- The homepage of the website will open on the screen

- Click on the Employer Login option

- The login page will open on the screen

- Now, enter your user name, password, and the captcha code

- After that, click on the login button to get logged in to your registered account

- The dashboard of your account will open on the screen

- Now, click on the Challan Number for the time you want to make the online payment

- Note down the challan number for future reference

- Click on the Continue button

- Now, under the Net Banking option, click on the State Bank of India

- Or else click on Other Bank’s option under the Other Payment Modes

- In order to access the bank’s online banking system, enter your login credentials.

- Verify the recipient’s information and the amount. If all is well, you can move on with the payment.

- Save the receipt for your records when the payment has been successfully made.

Steps to File Monthly Contributions

- First of all, go to the official website of ESIC i.e., https://www.esic.gov.in/

- The homepage of the website will open on the screen

- Go to the Online Monthly Contribution Screen and enter the information of your contribution.

- A new page will open on your screen with the preview

- Click Submit to complete the monthly contribution details with ESIC.

- For managing larger datasets, it is useful to attach an Excel file for bulk upload, or you can manually enter the contribution details for each employee.

- After submitting, click Pay online to start the online payment process through SBI net banking.

- To proceed with the online payment process, click “OK.”

- For future use, remember to write down the Challan number. To continue with the payment, click “Continue,” which will take you to the SBI online payment page.

- You will be taken to the banking website to complete the online payment through net banking as soon as you start the payment. Enter your net banking login information to finish the transaction.

- You will see a success page after your payment has been approved.

Steps to Generate an Online Challan

- First of all, go to the official website of ESIC i.e., https://www.esic.gov.in/

- The homepage of the website will open on the screen

- Click on the Generate Challan link

- A new page will open on the screen

- Click on the View option

- Enter the required payment amount and choose the record that the payment is to be made against.

- Now, click on the Online Option

- After that, click on the Submit button

- The notification about the request submission will show up

- Finally, click on the OK button

FaQ

What is the ESIC Online Payment Objective?

The main objective of ESIC’s online payment system is to enable consumers to pay their challan without having to visit government offices. This project increases system openness while saving time and effort

What is the Features & Benefits ?

Employees National Insurance Corporation members can now pay their premiums online.

Health Insurance Social Security Program for India Employees Employees National Insurance is provided by National Insurance Corporation.

Of the amount owed to employees, employers contribute 4.75%, while employees contribute 1.75

brothers, if you are liked given with the information then plz like and share so that other brothers can also be helped